tax exemption on mining equipment in ghana

MA tax guide SubSaharan Africa Deloitte US

MA Tax guide SubSaharan Africa ... Ghana 10 Kenya 12 Mozambique 14 ... Tax exemptions of three to five years is

Illinois Department of Revenue Regulations Processing ...

RETAILERS' OCCUPATION TAX SUBPART C: CERTAIN STATUTORY EXEMPTIONS ... equipment. The exemption ... mining process if the equipment is used to ...

Sales Tax Exemptions | North Dakota Office of .

The Sales Tax Exemptions page outlines various ... Coal Mine Machinery or Equipment A sales and use tax exemption and refund may be granted for ...

Canadian Taxation of Mining Mining Tax Canada

This article summarizes the Canadian taxation of mining activities. ... An exemption of up to 10 ... a leading resource on Canadian mining tax.

EXEMPTION AND ZERORATING UNDER VAT:

EXEMPTION AND ZERORATING UNDER GHANA'S VAT LAW. ... Fishing equipment. ... Scope too wide because exemptions under Sales Tax were preserved for public ...

Georgia – Exemptions for the Manufacturing, .

... simplifies the sales tax exemptions for the manufacturing, mining, ... equipment that is ... exemption from the 4% state sales and use tax rate and ...

GHANA DOMESTIC TAXES Blogger

The rest are Rural Banks, Real Estates Developers, Ghana Stock Exchange and Free Zones. 3. Tax Rates The tax rates for individuals mainly employees and selfemployed persons, companies as well as bodies of persons as indicated in the page on Tax Rates also serve as types of incentives to taxpayers. i. Individual Tax Rates With regards to .

Key Manufacturing and Mining Related Sales and Use Tax ...

Key Manufacturing and Mining Related Sales and Use Tax Exemptions for Machinery, Equipment, Materials, and Parts Mining % No phasein Manufacturing

Washington State Tax Guide TAXPEDIA

Washington State Tax Guide. ... Sales/Use Tax Exemption on Computer Equipment ... Mining and quarrying operations are extracting activities, ...

Ontario Mining Tax Ministry of Finance

Ontario mining tax is imposed on profits from the extraction of mineral substances raised and sold by operators ... To claim the mining tax exemption, ...

Manufacturing Machinery and Equipment Sales .

Manufacturing Machinery and Equipment Sales Tax Exemption. Sales Tax Exemption for a Specific Project; Utility Sales ... processing, mining, drilling, ...

'Extend exemptions to local companies' .

Graphic Online reports breaking news in Ghana and other major Ghana news making headlines today. From Ghana politics, business, ...

tax incentives in the Agricultural sector in .

tax incentives in the Agricultural sector in Nigeria. ... tax exemption for a ... country as regards the tax incentives in the agricultural sector.

Claiming Personal Exemptions on Federal .

Individuals are entitled to claim personal exemptions for themselves and for each dependent through tax year 2017. Find out how it works.

Tax Exemptions Ministry of Finance, Tanzania

Tax exemptions are listed in the schedules to the tax laws, ... Here you may download the database of tax exemption Government Notices ... equipment ...

Ghana Was Losing Annually In Tax .

Ghana over the years was losing about from tax exemption, the CEO of the Ghana Investment Promotion Centre, Yoofi Grant has disclosed. This is because the policy was being implemented wrongfully, he explained. According to him, the debilitating development led to the scrapping of the current tax exemption regime in the 2017 .

Ghana Corporate withholding taxes PwC

Detailed description of corporate withholding taxes in Ghana ... Ghana Corporate Withholding taxes. Choose a topic. ... West Africa Mining Tax Leader ...

Practice Note on Withholding of Tax | .

Practice Note on Withholding of Tax TAX LAW The CommissionerGeneral of the Ghana Revenue Authority is empowered under paragraph 2 of the Seventh Schedule of the Income Tax Act, 2015 (Act 896) to issue Practice Notes setting out the interpretations placed on provisions of the Act.

Contribution Minerals and Mining Sector to .

The mining sector has therefore been an important part of our economy, with gold accounting for over 90% of the sector. Ghana is the second largest gold producer in Africa and the 9th largest producer in the world. The sector directly contributed % of Ghana's total corporate tax earnings, % of government revenue and 6% GDP in .

Ghana

Ghana offers a relatively stable and predictable political environment for American investors. Ghana has a solid democratic tradition, completing its fifth consecutive democratic election in December 2008. The next election will be held in December 2012.

KRA Tax Exemption

Exemptions From Duty : ... Equipment imported by or on behalf of the ministry for the time being responsible for sports for the sole use of the Kenya ...

Machinery, Equipment, Materials, and Services .

Department of Taxation and Finance. ... exempt from sales tax. Computer equipment used directly in production also qualifies for the sales tax exemption.

Latest Posts

- الدولوميت المحمول الفك محطم الصانع المملكة العربية السعودية

- تهتز الشاشة سحق النبات

- كسارة الحجارة ذروة الجزائر

- طحن كرات مصر المصنعة

- تصميم الأساس لكسارة مخروطية

- مصانع الأسمنت عادة

- العوالم على أحسن وجه الرمال الصخرية صنع آلات

- أنظمة تشغيل طاحونة الكرة

- تصنيع كسارات متحركة 50 طن في الساعة

- كسارة المعادن الصين 600400

- الحجر محطة كسارة من عمان

- robo ماكينات الرمل pricing

- بيع دائرة مغلقة كسارة مخروطية

- سحق مطاحن الموردين

- قدمت السويد آلات مخروط مصر

- mobile rock jaw crusher

- used ballast crusher in italy for sale

- mobile crusher 60tph plant

- single cylinder lyconecrushershanghai

- limestone crushing and screen plants

- hot sale powder making raymond mill raymond mill for barite calcite li ne

- georgia europe manganese mining

- how to buy stone crushing machine in pakistan

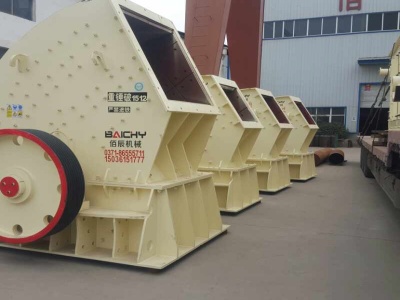

- high efficiency hammer crusher for construction equipment

- how to install a stone crushers

- china stone crusher dealer in india crusher

- hematite mining equipment

- con crusher 100 matrax

- mixing grinding machinary

- vibrating screen related to mechanical operation